Not sure what type of forecast will bring your business the most value to your business? In this article we take a look at the difference and benefits of short and long-term forecasting

If you’re interested in building your own cash flow forecasts check out our free guide + template.

For now we’re going to dive into the difference and benefits of short vs long-term forecasting.

On the Agenda:

- What is short-term cash flow forecasting?

- Why create short-term cash forecasts?

- Which businesses would benefit from short-term cash flow forecasting?

- Short-term forecasting tools

- What is long-term cash flow forecasting?

- Why create long-term cash forecasts?

- Which businesses would benefit from long-term forecasting?

- Long-term forecasting tools

- Building you own forecast + additional resources

What is short-term cash flow forecasting?

Short-term forecasts are a great, but underused tool, for managing cash. A short-term cash flow forecast can be defined as anything from a one-week forecast to 30 days, 90 days, or even a year into the future.

The advantage of these forecast are that by looking at the immediate future you gain the information and confidence to make high quality business decisions.

Where a long-term cash flow forecast typically looks at the cash balance at the end of each quarter or year (meaning it can overlook cash swings within a month or week.).

A short-term cash flow forecast looks in more detail, usually every day, at cash flows for the next three months.

Why create short-term cash forecasts?

Cash flow forecasting gives you more detail and insight on when and how you will be paying and receiving payments.

At a high level it alerts you to any cash shortfalls, so you can take early remedial action. Or, if you see you are going to have a cash surplus, you can confidently put it to better use in things like interest-bearing accounts, or invest it to grow your business.

It also helps answer more operational questions like:

- Can my team afford to take on this big project?

- Can we hire a new staff member this quarter?

- What happens if our biggest client pays late this month?

- Is it possible for us to delay a payment?

While cash flow forecasting might initially sound purely like a financial function, it ultimately helps you make better, more confident business decisions.

Which businesses would benefit from short-term cash flow forecasting?

While all businesses can benefit from short-term cash flow forecasting, some benefit more than others. Typically, smaller businesses in industries with ‘lumpy’ or inconsistent payments will benefit the most. Because these businesses lack consistent inflows and outflows they need to spend more time considering when, and how, they receive and give payments.

Example industries include:

- Construction

- Non-for-profit

- Agencies

- Artists

- Tourism & Hospitality

Ultimately, short term cash flow forecasting is critical for businesses where revenues and/or expenses are not steady and predictable – for example: new businesses, growing businesses, businesses changing their operations, and business in certain industries.

It’s also a great tool for businesses that are paying off debt, and/or looking for credit, getting ready to be acquired, or evaluating a variety of scenarios like expanding, increasing owner draws, and hiring

Short-term forecasting tools

Check out our Top 10 Cash Flow Forecasting Apps For Small Businesses for more.

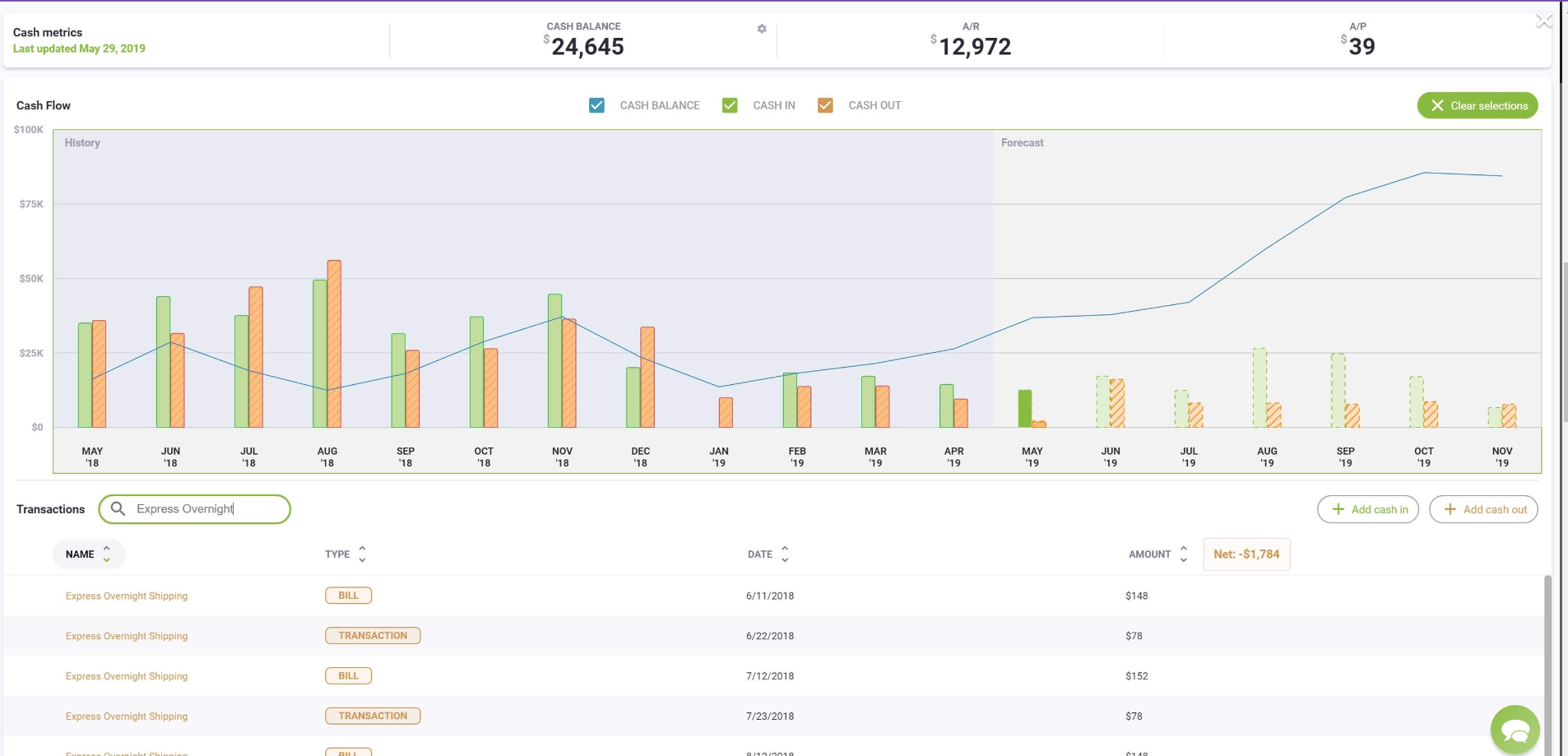

“The ultimate cash flow management & forecasting service letting you instantly know your cash flow today and tomorrow.”

Cashflow tool offer a Lite version of the software for free which can forecast up to 4-weeks and two paid tiers with the ability to forecast 6 months into the future and additional features.

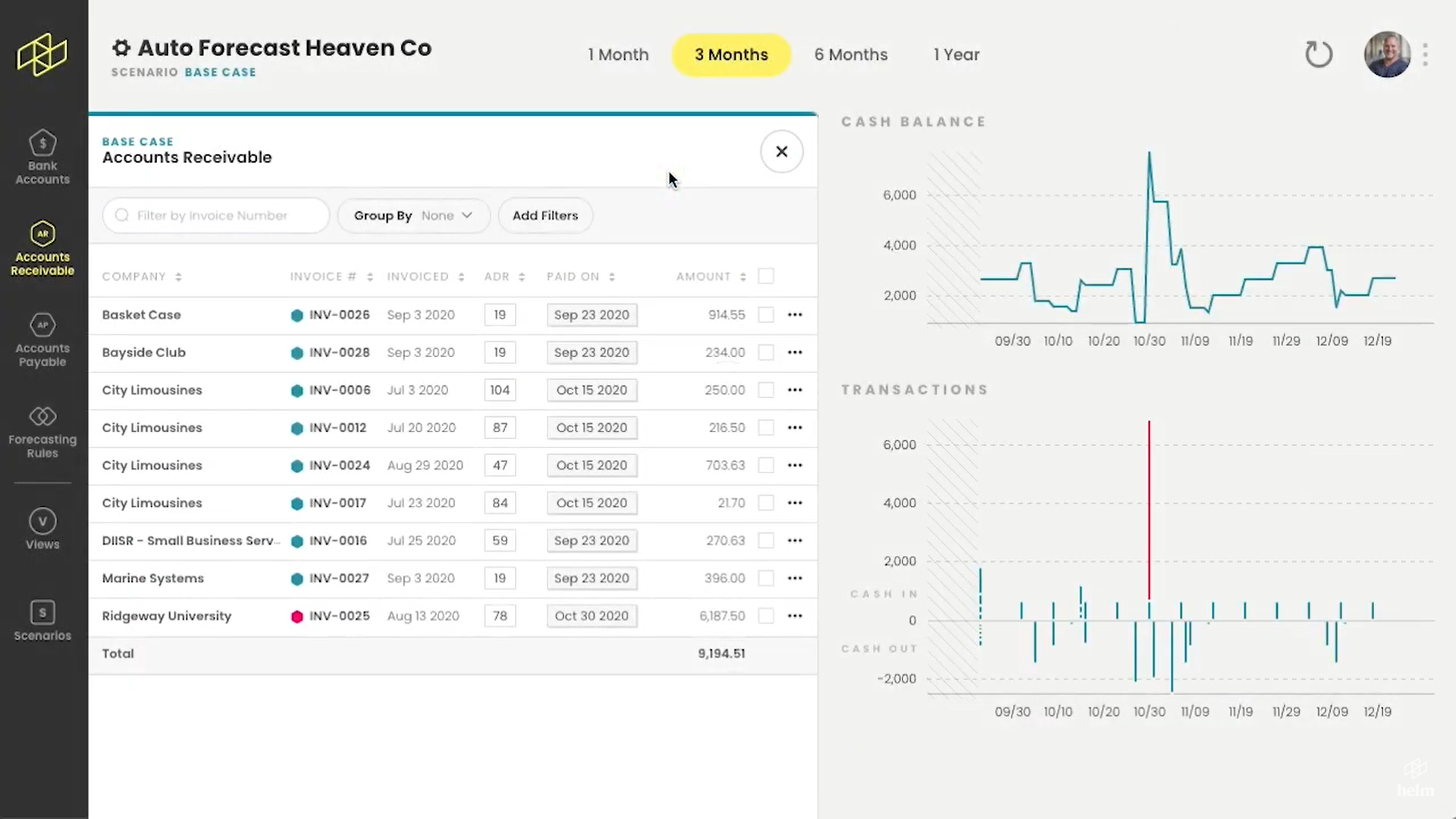

“Cash Flow Frog is a simple yet powerful cash flow management, forecasting, and scenario planning tool.”

Cashflow frog offers a standard version with the ability to create 1 year forecasts, and a Pro version with more features and 3 year forecasting.

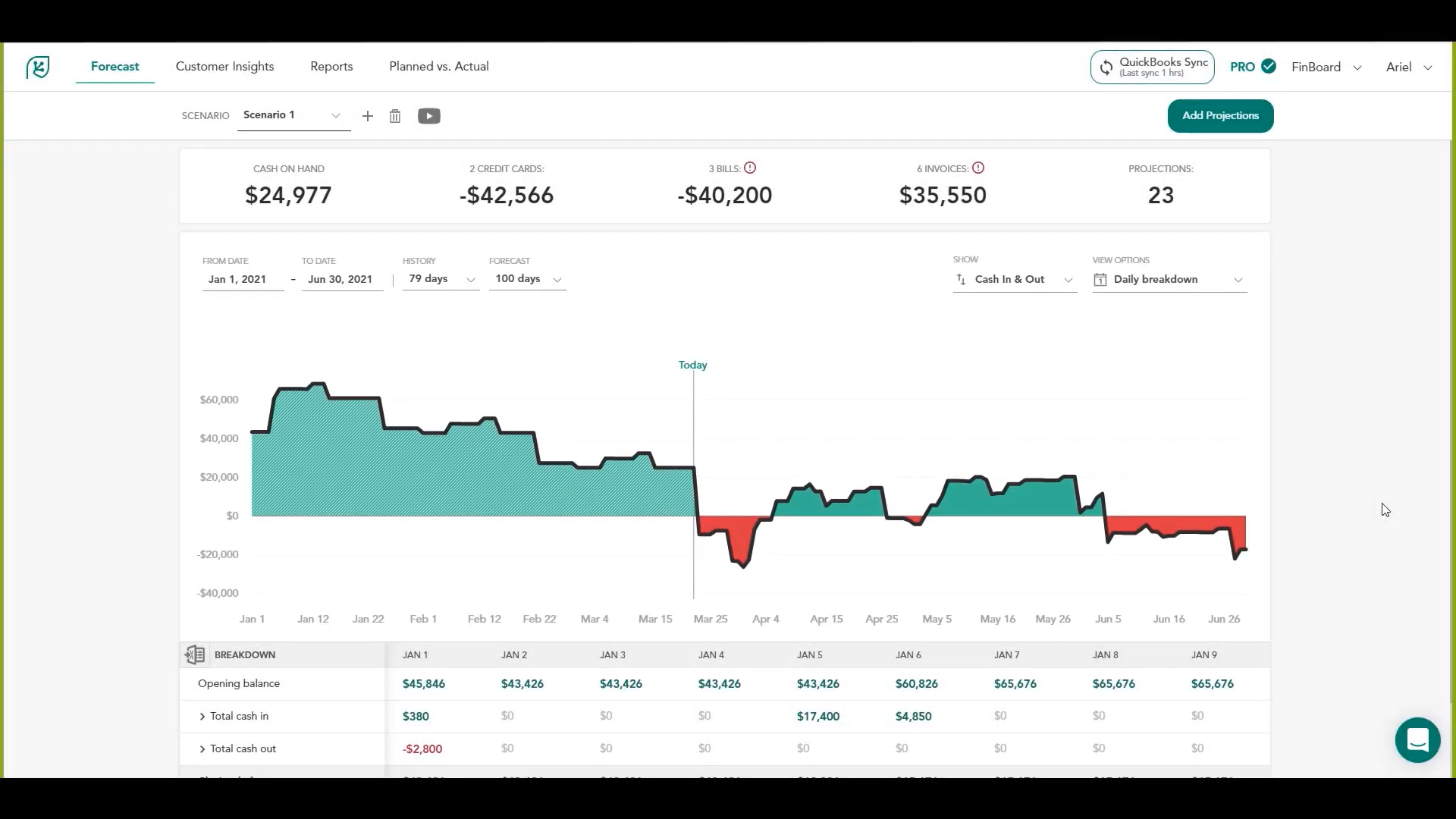

Cash flow forecasting is quick and simple with Helm.

Helm provides you with the numbers you need in real-time so you can make quick and confident business decisions, without spending hours creating budgets and forecasts in spreadsheets.

Helm has 1 month, 3 month, 6 month and 1 year forecasting options and integrates with QuickBooks Online, Xero, and Sage.

What is long-term cash flow forecasting?

Businesses often neglect long-term cash flow forecasting however, using it, you can make better and more well-informed decisions in your business.

As we discussed, short-term is up to 12 months, typically in monthly or even weekly increments. On the other hand, medium and long-term forecasting looks 2 to 5+ years out, and is typically in quarterly or yearly increments.

When creating a long-term forecast a good starting point is to create a budget for the long-term based on past financial statements. Then, taking them as a base, you can add expected sales, costs of future projects, and markets you plan to enter into your budget.

Why create long-term cash forecasts?

Fundamentally, long-term budgeting is putting your strategic goals into numbers. It’s a good prediction of what cash inflows and outflows your business will be experiencing in the future.

Periodically compare actual results to what you forecasted earlier, and adjust your budget accordingly for the future. Reviewing your budget will reveal areas of your business that are most and least profitable. This gives you an indication of which projects to drop and which need more attention and resources.

Which businesses would benefit from long-term forecasting?

A variety of businesses can benefit from long-term forecasting. Especially those with large, long-term projects or those with large inflows or outflows they expect to happen outside of the next twelve months.

Long-term forecasting tools

“The growth focused planning solution.”

“Finally a purpose built all-in-one FP&A solution, unlocked by the power of driver based financial modeling”

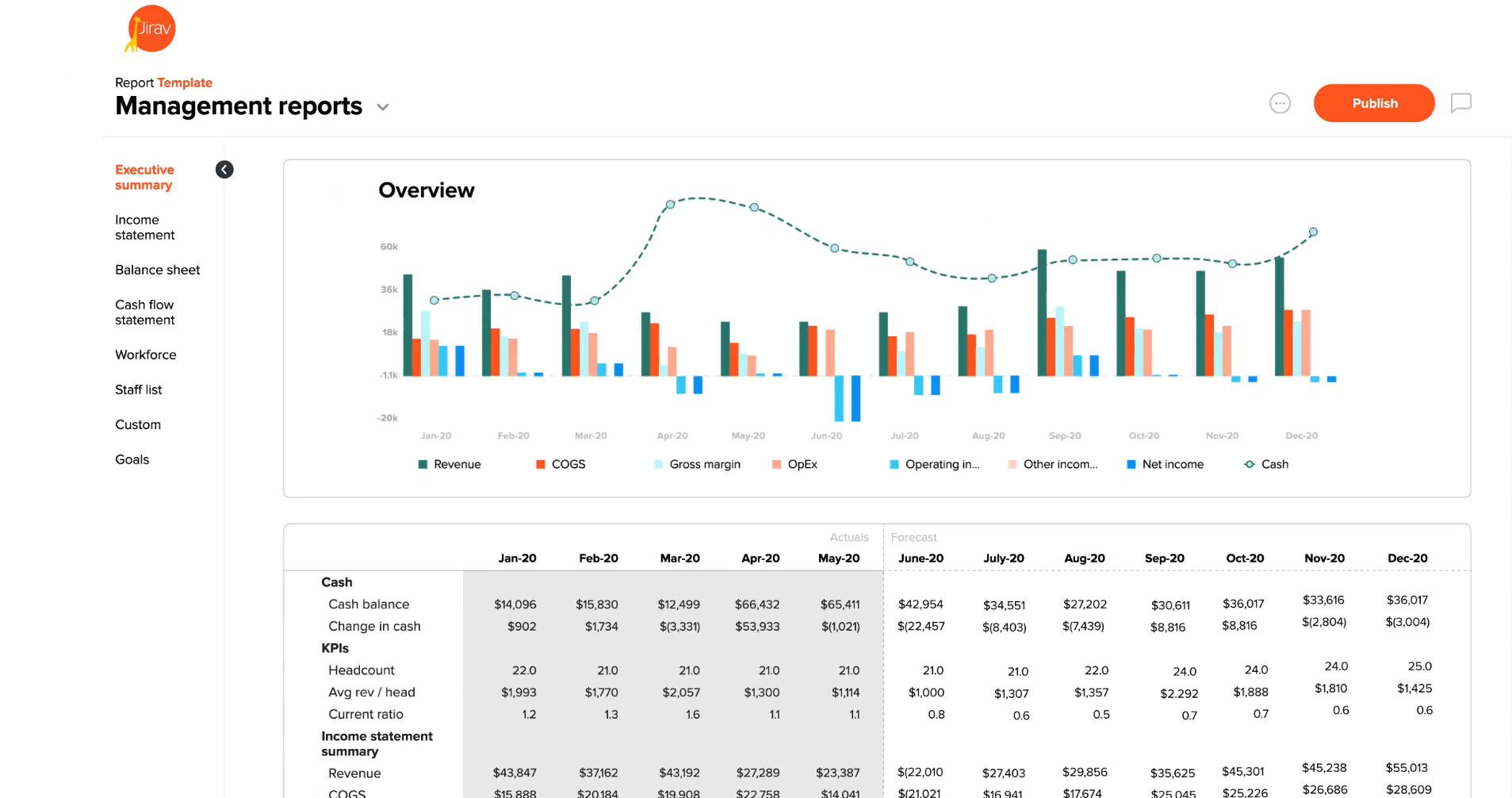

“All-in-one reporting, analysis & forecasting.”

“Fathom combines insightful reporting, fast cash flow forecasting and actionable financial insights into one refreshingly easy business management solution.”

“True cashflow forecasting and business modelling.”

“Castaway is a comprehensive and intelligent business modelling and cashflow forecasting tool. Castaway’s powerful business modelling, scenario planning, dashboarding and reporting retains the integrity of your forecasts with double-entry accounting. Castaway helps you tell the story of your business.”

Building Your Own Cash Flow Forecasting

Today we’ve seen the benefits of short and long-term forecasting and how they can help your business.

Check out more resources below to help you get started with forecasting in your business.

- Cash Flow Forecast Guide + Free Template

- The Top 10 Cash Flow Apps for Small Businesses

- The 3 Levers of Cash Management

- How to calculate cash burn rate and runway

If you’re interested in seeing how Helm could help you forecast, manage your cash and make better business decisions you can learn more here.