Looking for a crystal ball? Would you settle for 3-5 year financial and strategic planning? A 3-way forecast may be just what your looking for.

On the agenda

- Why should I create a 3-way forecast?

- What is a 3-way forecast?

- The 3 components of a 3-way forecast

- Why is a 3-way forecast important for businesses?

- When should I create a 3-way forecast?

- Who should create a 3-way forecast?

- How to create a 3-way forecast

- Benefits of using software

- Key software features

- 3 of the top 3-way forecasting apps

Why Should I create a 3-way Forecast?

3-way forecasts are particularly useful in business planning, and when trying to improve the accuracy of your business decisions. They’re also used by business owners and mangers when trying to evaluate business performance and financial health.

Elsewhere, banks and potential investors commonly review them when evaluating a business, so creating a 3-way forecast can be useful when trying to secure funding.

What is a 3-way cash flow forecasting?

A 3-way cash flow forecast is a financial projection or model that combines the 3 main financial reports into one consolidated forecast. Strong 3-way forecasts are robust and provide accurate and comprehensive forecasts typically over a 3-5 year horizon that are reported in quarterly increments.

3-way forecasts use real time and historical data from your income statement, balance sheet and cash flow statement to provide an accurate forecast to be used in business analysis and management reporting.

It’s called a 3-way forecast because of the 3 financial reports it consolidates:

Income statement (Profit & Loss)

Balance sheet

The 3 components of a three-way forecast

The income statement shows the projected revenues and expenses for the business, as well as the resulting net income or loss.

The balance sheet shows the projected assets, liabilities, and equity of the business at a specific point in time.

The cash flow statement shows the projected inflows and outflows of cash for the business, including operating activities, investing activities, and financing activities.

While the income and cash flow statements might, at first, seem similar, key differences make both essential for businesses. See why your business needs to be tracking both profits and cash flow here.

Why is 3-way Cash Flow Forecasting Important for a Business?

A three-way forecast is important in future planning for a business. It allows managers and a business to feel confident about the company’s future.

Operationally 3-way forecast can help you make better decisions by reporting on financial performance. It should also give you a clear budget and a long-term, high-level, cash flow forecast.

From a strategic stand point a 3-way forecast helps in creating business plans, and in seeing if you will be able to financially execute long-term strategies.

A 3-way forecast can also be helpful when trying to receive funding from banks or investors.

When Should I create a 3-way Forecast?

When you’re looking to forecast and plan financially and strategically for next 3-5 years.

Who Should Create a 3-way Forecast?

3-way cash flow forecasts tend to work best for larger organizations. That’s not to say that small businesses can’t benefit, just that they likely have more immediate priorities.

If your a small business owner or have worked in a small business you know the challenges. A lot of your stress is probably focused on the current, more immediate cash flow and operational concerns such as:

“Can we afford a new piece of equipment in 6 months”

“Are we able to hire someone this year?”

“Will we have enough money to pay our bills and wages this month?”

On top of this creating a 3-way cash flow forecast can be a time consuming process for a small team.

That’s why for small businesses cash flow forecasts often have a greater impact and are more attenable to create (more on the challenges of creating a 3-way forecast below).

On the other hand larger organizations, who tend to have no, or limited short term cash flow concerns, are more focused on the coming years and long term planning.

For large scale organizations, a 3-way forecast can be a great fit as it gives them longer term business insights and financial forecasts.

How to Create a 3-way Forecast

Above, we briefly alluded that creating a 3-way forecast can be a time consuming and complex process. Why’s that?

Well you’ll recall that a 3-way forecast is named so because it consolidates the:

Income statement (Profit & Loss)

Balance sheet

To combine them and create a 3-way forecast you’ll need to:

Input financial information into spreadsheets (i.e. google docs, Excel)

Create a Cash Flow Statement

Forecast the Balance Sheet

Forecast the Income Statement

Forecast capital assets

Forecast any financing activity

That’s a lot of work, especially if you’re doing it manually! And quite frankly, it’s not worth getting lost in time consuming spreadsheets. Not that a 3-way forecast isn’t valuable, but your time could be more productively and enjoyably spent elsewhere.

Thankfully, were not the only ones who have a had the same thought.

That bring us to software you can use to create 3-way forecasts without the hassle.

Benefits of Forecasting Software

Before we jump into some key feature, and review some specific tools on the market let’s take a look at:

Q: What are the key benefits you can expect from using forecasting software compared to manually creating a forecast?

A: By using software you’ll save time, save on tedious manual work, increase the accuracy of your forecast by eliminating the chance of human error, and free up you or your team to work on other items.

Key Features of Budgeting and Forecasting Software

Here are some key features you should look for, and can expect in many 3-way forecasting apps.

Consolidates Income Statements, Balance sheets, and Cash Flow Statements

3-5 year time horizon planning

Scenario Planning

Dashboard for Key performance indicators (KPIs)

Variance analysis

Long-term cash flow forecasts

Financial analysis and reports

Ability to create custom reports

Budgeting vs actuals data

Ability to consolidate multiple companies

Data integration with multiple sources including accounting software, spreadsheets, and CRM systems.

Among other features! A 3-way forecast is a comprehensive and complex forecast and the best apps aim to deliver a wide variety of features.

Now let’s take a look at some of the top apps on the market including key features and pricing.

The Top 3-way Forecasting Software

This list is not extensive (there are many apps on the market), but below we’re going to take a look at 3 of the most popular tools.

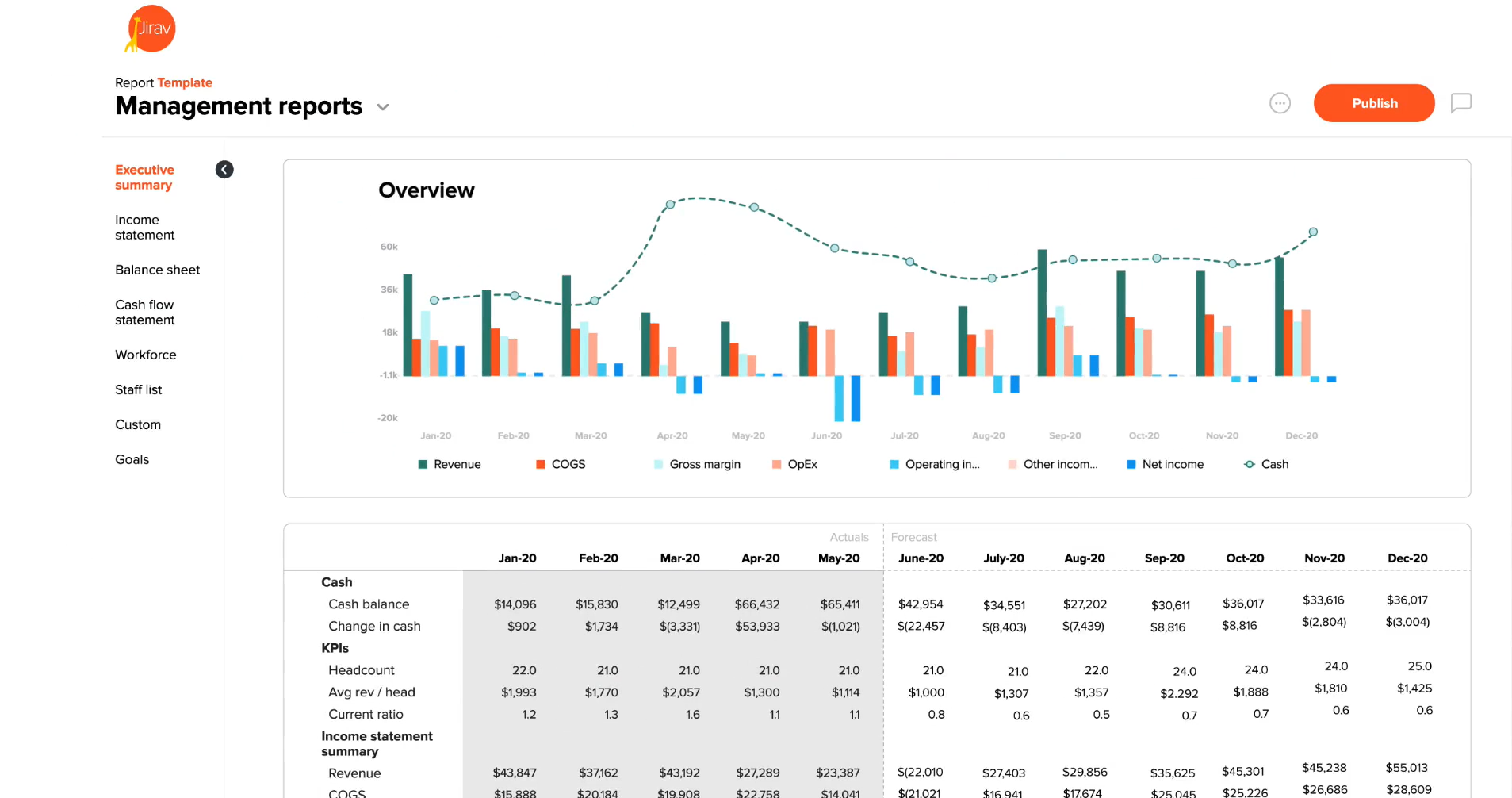

1. Jirav

Jirav label themselves as “The growth-focused planning solution”.

They offer solutions tailored for growth companies, accounting firms, and venture capital (VC) backed companies.

Key Features:

Reports & Dashboards

Report packages

Variance analysis

Cash flow analysis

Operating plan & budgets

Sales & workforce planning

Scenario planning

Rolling forecasts

See Jirav’s list of integrations here.

Starting from USD $10,000 a year ($834/month).

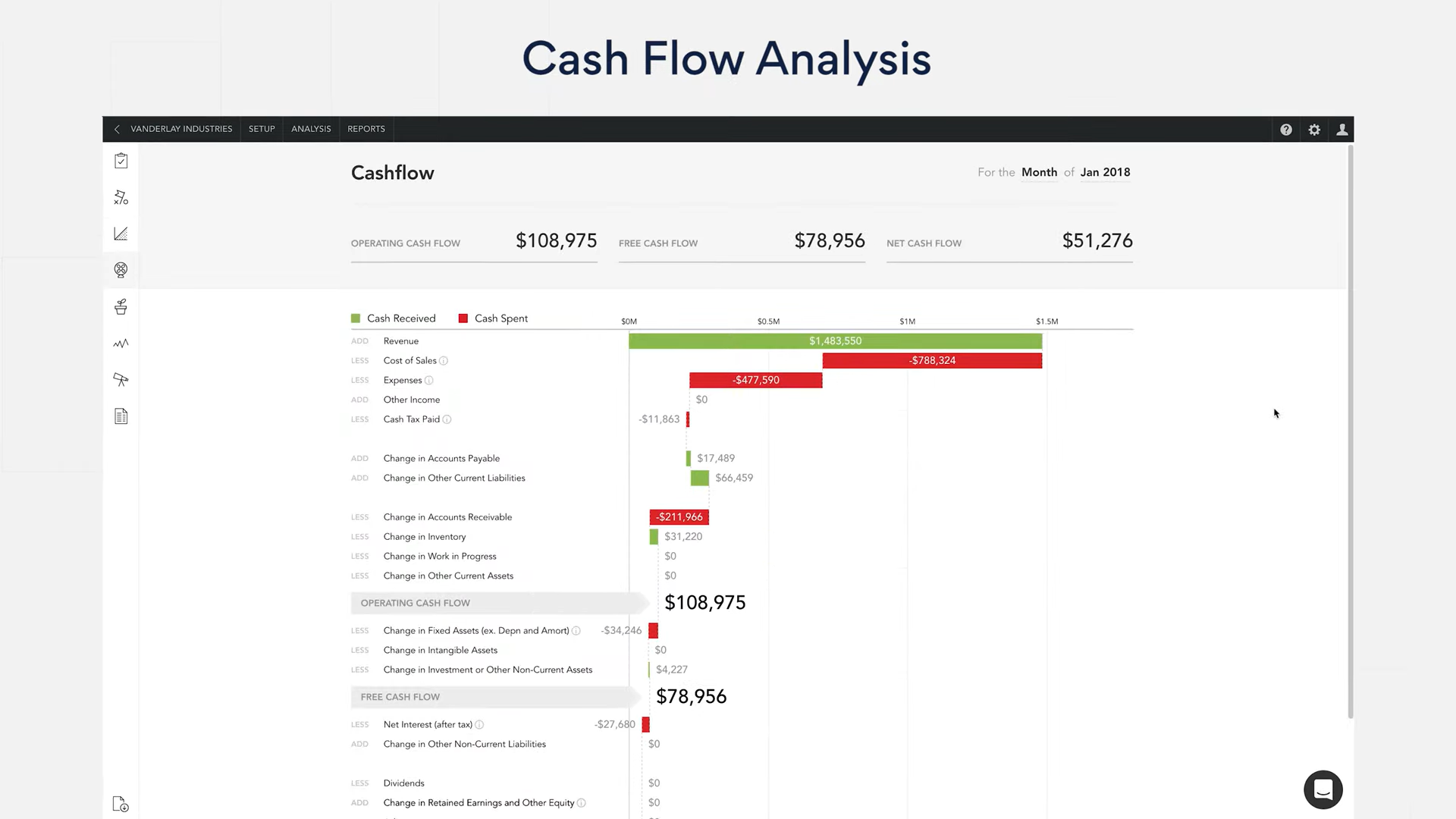

2. FATHOM

“All-in-one reporting, analysis & forecasting.”

“Fathom combines insightful reporting, fast cash flow forecasting and actionable financial insights into one refreshingly easy business management solution.”

Key Features:

Three-way forecasting

Aggregate financial statements for up to 300 entities

KPI Analysis (including custom KPIs)

Scenario based planning

Variance, Divisional, Cash Flow, Trend, and Growth Analysis

Report Editor

Variance reporting

See Fathoms list of integrations here.

US$ 648-9600/year ($54-800/month).

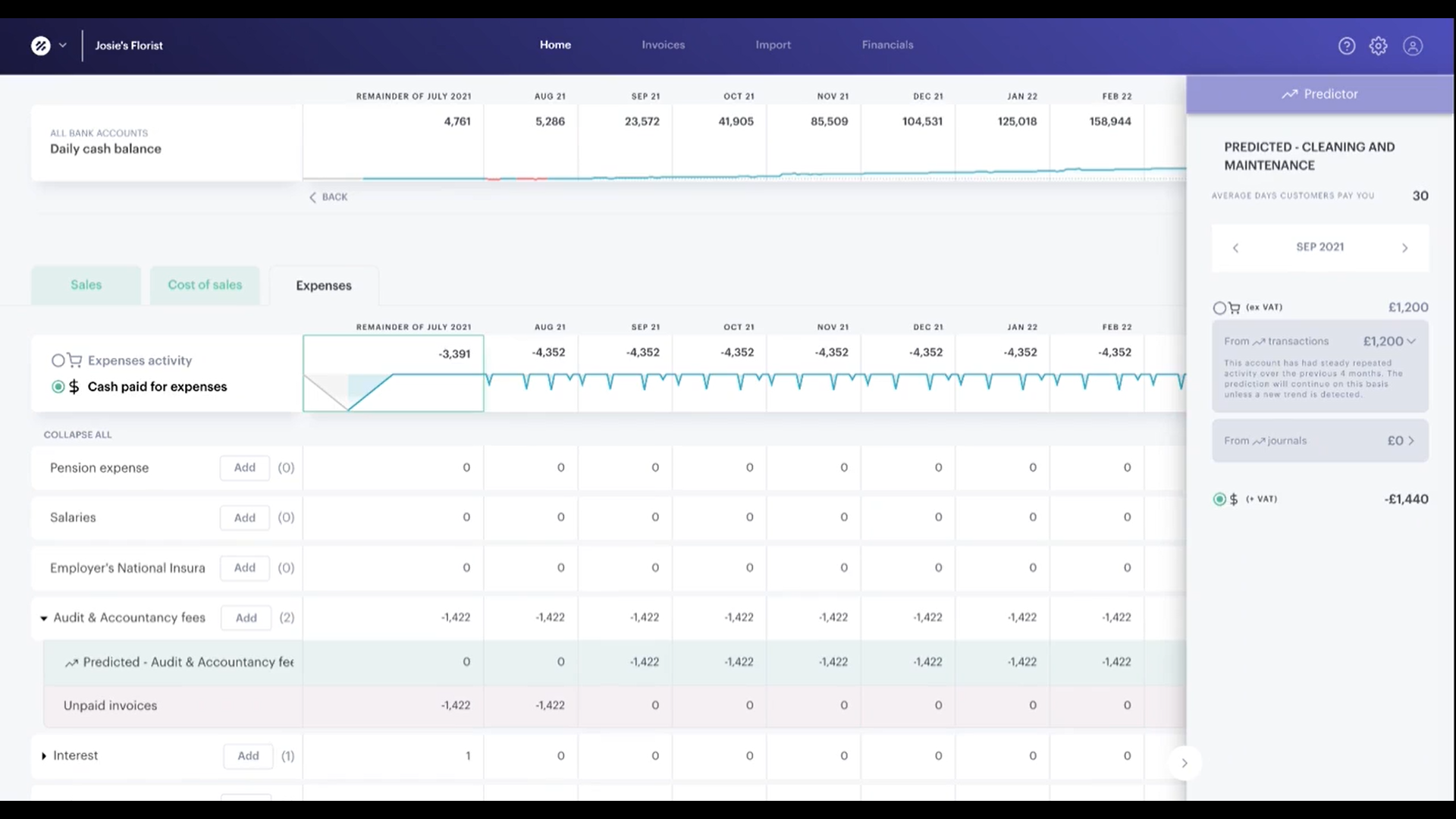

3. Futrli

“Real-time cash flow forecasting and reporting”

“Prepare for 3-year forecasts that use all your accounting data.”

“Operations, staff, profit, trends, bills, sales, tax… It’s all predicted across the P&L, Balance Sheet and Cash Flow.”

Key Features:

Sales, expenses, profit, cash flow, tax and growth insights

Actual performance to any budget, forecast, or plan

Top 10 sales, expenses, customers & suppliers

Customer & supplier detailed insights and risks

Deep instant cash flow insights

See Futrli’s list of integrations here.

US$ 420-3600/year ($35 -300/month).

SUpporting your 3-way Forecast

Throughout we’ve talked about how 3-way forecasts are complex forecasts designed to help with planning and management over the next 3-5 years.

To support a 3-way forecast then, you’ll want something that covers its weaknesses. Primary the time it takes, and its lack of focus on the short-term.

That’s why a cash flow forecast is an ideal companion to a 3-way forecast.

A short-term cash flow forecast, let’s you see your cash balance over the coming days, weeks, months and year. Letting you confidently make operational decisions, test scenarios, and manage your receivables and payables.

And the best news? Cash flow forecasting software costs a fraction of the cost of 3-way tools!

Note: See how you can get automated cash flow forecasts for just $32/month with Helm here!

-png.png)

Above: Screenshot of a cash flow forecast in Helm.

THe right path

Be sure to explore your options, and find the one that’s best tool for your needs. Don’t be afraid to test them for yourself by taking advantage of free trials.

For more check out our list of the top 10 cash flow apps!

Until next time!