Cash is king for any business. Today, we’ll be looking at 10 of the top cash flow forecasting and management apps on the market. For each one you’ll find some key features, drawbacks and the latest pricing

We’ll be highlighting tools with a range of pricing and feature sets to help you find the best one for your business!

Interested in learning more about cash management and cash flow forecasting?

Check out these resources:

What is a Cash Flow Forecast and Why is it Important for Small Businesses?

- The 3 Levers of Cash Management + How to Leverage Them

- Short vs Long Term Cash Flow Forecasting: When, Where and How to Use Each

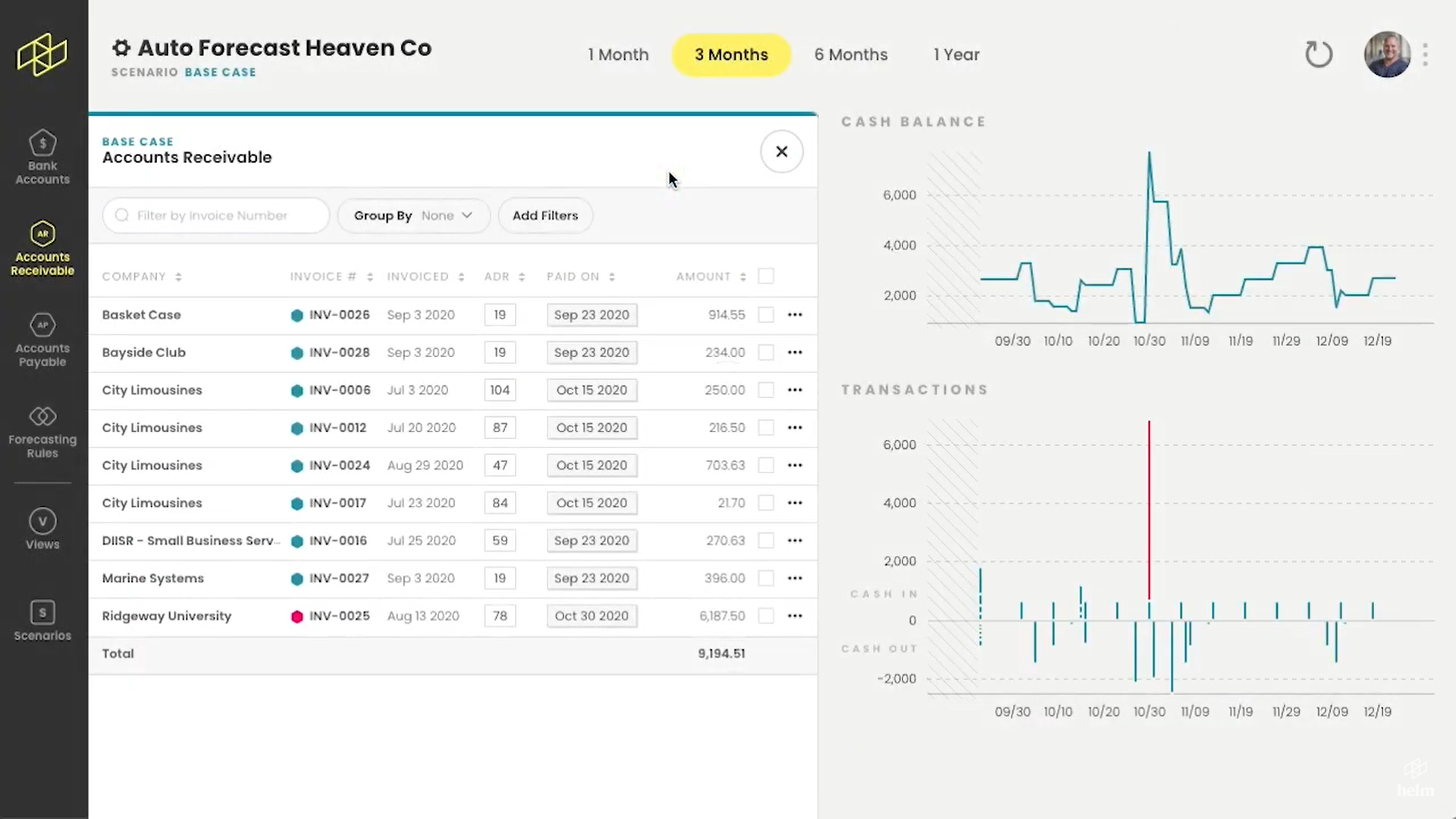

1. Helm

Designed by accountants and small business advisors, Helm lets you see your future cash position in real-time, so you can make confident business decisions without wasting hours in spreadsheets.

Key Features:

- Integrates with: QuickBooks Online, Xero, Sage and Veem.

- Provides 1-month, 3-month, 6-month and 12-month forecasting with various viewing options

- Test unlimited scenarios side-by-side

- Analyses the historic transaction data of each contact to predict how you will be paid in the future

- Key financial metric dashboard to stay on top of your business’ financial health

- Make payments directly from Helm through Veem

- Cash flow dashboard for understanding financial health at a glance

Drawbacks:

- Limited to forecasting up to one 1 year

- While you can export reports to Google Sheets/Excel Helm currently does not support any in app budgeting.

Price: US$ 32/month per connection

- Integrates with : Xero, FreshBooks, QuickBooks Online, QuickBooks Desktop, and Sage Intacct

- Analyze and plan your cash flow up to 3 years ahead using daily, weekly, monthly and quarterly perspectives

- View planned versus actual reports

- Consolidates data from multiple companies into a single cash flow forecast

- Number of users is limited to 2 and 10 users for the standard and pro plans respectively

- Number of scenarios you test is limited in the standard plan to just 3

- Pricing is based on revenue (increases based on revenue)

Cash flow tool is designed small business users and and offers a free lite version of their software with a limited feature set.

Key Features:

- Free lite version available

- Integrates with QuickBooks Online and QuickBooks Desktop

- Provides 4-week and 6-month forecasting

- Unlimited users in Plus and Pro plans (1 Users in free plan)

- Includes a cash flow calendar and what-if planning

- Access to built in video coaching and tips

Drawbacks:

- Limited to 6-month forecasting

- Features highly dependent on which plan you choose

- Pricing highly dependent on plan you choose

Price: US$ 0 -100/month per business connected (scales by plan)

4. Fathom

Fathom combines insightful reporting, fast cash flow forecasting and actionable financial insights into one refreshingly easy business management solution.

Key Features:

- Integrates with QuickBooks Online, QuickBooks Desktop and Xero

- Tracks key KPIs and financial reporting and analysis for metrics like profit and growth

- Creates ‘three-way cash flow forecasts’ that project P&L, Balance Sheet & Cash Flow statements.

- Schedule the delivery of financial reports

- Create custom reports

- Forecasts up to 3 years

Drawbacks:

Cash flow forecasts limited to monthly, quarterly or annually (no daily or weekly)

Price: Starting at US$ 54/month (scales with number of companies connected)

5. Float

Get a real-time, visual view of your cash flow and make more confident decisions about the future of your business.

Key Features:

- Integrates with QuickBooks Online, Xero and FreeAgent

- Budgeting to actual reporting

- Weekly cash flow summary email

- Up to 3 year cash flow forecasting

Drawbacks:

- Max users: 3-100 (depending on plan)

- Number of scenarios limited by plan (5-100)

Price: US$ 59- 249/month (based on plan and billing option)

Dryrun provides an automated, cloud-based solution for cash management, financial modeling, and business forecasts.

Key Features:

- Integrates with: QuickBooks Online, Xero, QuickBooks Desktop, Sage Accounting, and Pipedrive

- Unlimited forecasts & scenarios

- Auto forecast capability

- Consolidate scenarios

- Weekly action reports

- Live currency conversion

Drawbacks:

- Takes some time to learn the interface

- Focus on forward-looking rather than past reporting

- Price on the high end

Price: US$ 200-400/month

7. Jirav

Created to accelerate growth. Build growth plans, scenario test, measure plan vs. actual. Gain financial excellence and find your path to faster growth.

Key Features:

- 5 year rolling forecasts

- Financial metrics and reporting dashboards

- Create and manage operating plans and budgets

- Sales & workforce planning

- Revenue growth & business modeling

Drawbacks:

- Greater focus on financial reporting and strategic planning than cash flow management

- Feature set less tailored to small businesses

- High cost

Price: US$ 500-1000/month

8. Futrli

Live, accurate, updating predictions generated from your own accounting data keep you on track, ready for you to layer your own plans on top.

Key Features:

3-way cash flow and financial reporting and predictions

Analyzes customer payment trends

Predict Sales and Expense Activity

Google Sheets hot-links

Drawbacks:

Although they were recently acquired by Sage, currently Futrli only integrates with Xero and QuickBooks

3-way forecasting may not be what small business owners want when looking for a cash flow management tool

Less visual than other tools on the market

Price: US$ 20-35/month per connection

QuickBooks Online offers a built-in tool free for users of their accounting software. For QBO users, it serves as a great starting point for newcomers to cash management.

Check out our guide on how to use QBO’s forecasting tool here.

Some Key Features:

Creates forecasts for up to the next 12 months

Lets you view all your upcoming transactions

Includes basic scenario planning

Drawbacks:

Lacks ability to compare multiple scenarios at once

Simple feature set compared to others on the list

Price: *Included with subscription to QBO

For Xero users who aren’t currently doing any kind of cash flow forecasting or management Xero’s built in tool can be a great starting place. Best of all it comes free with all levels of your Xero subscription!

Check out our guide on how to use Xero’s forecasting tool here.

Some Key Features:

Offers simple 7-day and 30-day cash flow reporting

Allows yo to see upcoming invoices and bills to paid and your projected cash balance

Drawbacks:

Limited to 7-day and 30-day forecasts

Lacks any form of scenario planning

Price: *Included with subscription to Xero

That's a wrap

We’ve seen 10 of the top cash flow apps on the market, there’s more out there and more to learn about each. Remember you know your business better than anyone, so prioritize the features most important to you, to find the right tool!

Don’t be afraid to try them for yourself, most cash flow forecasting apps have a free trial period where you test them with your data.

Until next time!